This week in Get a Room, 's roundup of news on hotels and accommodations in San Francisco and the Bay Area , we track the latest hospitality analytics for hotel room stays in the city over the first quarter of the year. Although San Francisco is trending in the right direction, there's an outside force beyond its control that's starting to drag on this progress.

Elsewhere, a looming sale of two major downtown hotels could continue the city's rebound from the dregs during the pandemic. The only problem is that there's a threat of foreclosing on the hotels before a deal is reached. And elsewhere in the Bay Area, a posh hotel pops up to target a particular guest, and a novel art space replaces a former SRO hotel in a charming downtown.

SF hotels take two steps forward, one step back

Hotel occupancy and room rates are slightly up this year in San Francisco, according to data from hospitality industry data provider CoStar, but lodging overall still hasn't returned to the halcyon days of before the COVID-19 pandemic.

The era when San Francisco hotel owners made money hand over fist - like in 2019 after hotel rooms notched a new record for average daily rate: $273.61 - hasn't returned. San Francisco still ranks at the bottom of its counterparts in major hospitality markets for recovering from the pandemic, CoStar found.

A rash of mortgage defaults and hotels voluntarily turning their keys back in to their lender rocked the local market over the years. And while a full recovery is not expected until 2031, San Francisco hotels are seeing incremental improvements and trending toward the right direction.

There was an improved performance in the first four months of the year, bolstered by marquee events like the city's first hosting of the NBA All-Star Weekend during Valentine's Day weekend, said Michael Stathokostopoulos, senior director of hospitality analytics for the CoStar Group.

CoStar statistics showed that the average hotel occupancy was 64.2% between January and April of this year. That is up 6.6% from the same period last year, but still below the 79.5% occupancy for the same period in 2019.

The average room rates - $241.93 - for the first four months of the year are also up 7.1% from 2024.

Although short about $14 from the average room rate between January and April 2019, the cumulative inflation rate over the last six years increased by more than 25%.

Stathokostopoulos explained how countless news articles feasting on San Francisco's downtown in decline had an effect on scaring people away. "San Francisco experienced years of negative press," he said. "There is a lingering impact, deterring visitors and causing some relocations for convention center events that are booked up to five years in advance."

The Moscone Center is also rebounding, hosting the "world's largest event for the data and AI community" from Databricks in June, but its full recovery timeline is tethered to hotel rooms. Rooms booked by conventions are expected to exceed 600,000 in 2025, about 40% above 2024 levels, but that's still below the pre-pandemic long-term average of 850,000 annual room nights.

For the travel industry, an important financial metric is hotel revenue per available room, or RevPAR. The average hotel in San Francisco, the CoStar data shows, received $155.23 per room per night in the first four months of 2025. That was up a notable 14.1% from last year, but still down 20% from before COVID-19.

Stathokostopoulos reads positivity in the tea leaves. He sees the San Francisco hotel market significantly gaining from two major sporting events in 2026: hosting six games of the FIFA World Cup and the Super Bowl at Levi's Stadium. Although the football stadium is in Santa Clara, the Moscone Center is hosting various Super-Bowl related events that boost hotel demand, the hotel analyst said.

BEST OF

History | The incredible implosion of the Bay Area's biggest pyramid scheme

Food | Tragedy almost shuttered this Berkeley brunch institution

Culture | Inside the Bay Area's cult-like obsession with Beanie Babies

Local | The world's last lost tourist thought Maine was San Francisco

Get 's top stories sent to your inbox by signing up for The Daily newsletter here.

Adding to the difficulties, San Francisco's hotels are also subject to downward demand that's out of their control. Some international travelers are anxious about visiting the country during the second Trump administration. Stathokostopoulos said 20% of San Francisco visitors are from other countries and that in response to the Trump administration, they're seeing a "lagging demand from inbound international travelers."

In addition, Stathokostopoulos said downside risks to the forecast have recently emerged due to a deteriorating outlook for the international economy and a potential further slowdown in both domestic and international inbound leisure-related travel.

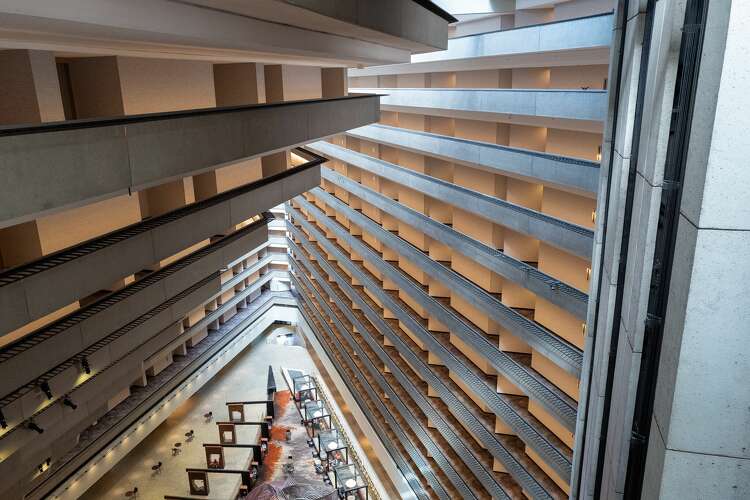

A 1,921-room canary in the coal mine

Investor viewpoints on the future prospects of the San Francisco hotel market near-term appear to hinge on whether a deal can be struck on the ownership of the Hilton San Francisco Union Square and the Parc 55, two of the city's largest hotels.

The fate of the Hilton, the largest hotel in the city with 1,921 rooms, and the Parc 55, the fourth largest, with 1,024 rooms, was put in limbo when Park Hotels & Resorts walked away from making payments on the $725 million mortgage on the properties in June 2023.

The following year in July 2024, the Kroll Bond Rating agency valued the two hotels at $538 million, a 65% drop from a 2016 appraisal that formed the basis of the $725 million mortgage. The Real Deal reported in March that an unidentified buyer for the hotels had been found, but a deal has yet to be announced .

Now, a receiver is running both hotels. The San Francisco Business Times reported earlier this month that the receiver had asked the San Francisco Superior Court for a revised June 29 deadline to sell the hotels given the pending deal.

If the court does not extend the deadline, and a deal can't be finalized, it is expected that lenders would begin foreclosure proceedings. Some hotel consultants have suggested that the hotels become residential housing if a deal cannot be struck to continue them as hotels.

There's another lingering complication: upkeep costs. Park Hotels said in an investor presentation in 2023 that the two hotels would need $200 million in expenditures to keep them up to Hilton brand standards.

Meanwhile, Park Hotels sold another local hotel property. In an investor presentation in May, the real estate trust announced it had sold the 316-room Hyatt Centric Fisherman's Wharf for $80 million. The buyer: New York hospitality company EOS Hospitality. Park acquired the hotel in May 2019 as part of a merger with the Chesapeake Lodging Trust. Chesapeake bought the hotel in 2013 for $103.5 million.

Park in its announcement selling the property, said it considered it a non-core property. Back in 2019, it said it was merging with Chesapeake to get more exposure to the SF market, which would be one of the five hottest hotel markets in the U.S. over the following two years. Of course, no one could have predicted the pandemic and its effects on the city.

After unexpected turns over six years, Park is left with only one San Francisco hotel: the J.W. Marriott San Francisco Union Square.

Bay Area's biggest (and most posh) hotel opening

The San Jose and Silicon Valley hospitality industry has also severely suffered since the pandemic with business travel severely down with the mass adoption of remote work. But Starwood Hotels selected Sunnyvale for the location of its first Treehouse hotel in the U.S. It's only the third location in the world, and the other two are in England.

The hotel opened in May, and it's one of the only new lodging establishments in the Bay Area to open in 2025. At rates that start at more than $400 a night, if you prepay during the week for a standard room, the hotel is aiming for the moneyed tech crowd.

Treehouse bets that tech workers will pay for its unique design and also location. The hotel is surrounded by Google's Moffett Park Campus, home of the Google Cloud, and also close to Apple, Meta and other big tech companies.

An all-glass lobby in its own separate building features a 1967 Volkswagen Beetle full of flowers and moss. The tree house theme is also taken literally; wallpaper features trees, bedside tables are shaped like tree stumps and there's an owl embroidered on throw pillows. Some rooms also contain book nooks and record players with a selection of vinyl to play. The 111 rooms are scattered in various accommodation buildings over a 50-acre site that includes an outdoor swimming pool and a book swap house .

The site was originally home to a fruit orchard, and there are century-old trees still onsite. It was later adapted into the Sheraton Sunnyvale Hotel before it's latest transformation into a trendy hotel with a beer garden.

The hotel's flagship restaurant is called the Valley Goat and features California cuisine from James Beard Award-winning chef Stephanie Izard (behind the celebrated Chicago restaurant the Girl & The Goat).

"Treehouse Hotels brings all the things we crave but rarely make space for, nature, spontaneity, fun and games, and a little bit of nonsense," wrote Barry Sternlicht, the billionaire hotel magnate behind Treehouse hotels, in a statement .

Sternlicht also founded the Starwood brand, which sold to Marriott for over $13 billion in 2016. As part of the deal, Sternlicht got to keep the Starwood name. His group also owns the 1 Hotel brand, which has a location on the Embarcadero.

In an interview with , Treehouse general manager Alyssa Robin said the hotel is not only aimed at business travelers. She said on weekends, the hotel offers a discounted price range, in the mid-$200 range, hoping to attract individuals and families on the Peninsula looking for a weekend getaway or staycation.

As for the nearly double rates on weekdays, Robin said that tech workers will be willing to pay to stay in a hotel with a creative environment instead of a cookie-cutter lodging establishment.

Former mayor revives 113-year-old hotel

In 2012, former Redwood City Mayor Dani Gasparini and her husband Alyn Beals purchased the Hotel Sequoia in the heart of their city's downtown. Before the acquisition, the Sequoia was a residence for homeless people that helped them find housing. The couple's vision for the historic building, which opened in 1912, was revamping it into luxury lodging.

After more than a decade of planning, the first floor of the hotel building opened as a 35,000-square-foot temporary arts center in May. A hotel is not expected to debut for another couple of years.

"The public hasn't been able to step inside for over 30 years because it was run as a SRO," Gasparini said. That's now changed as the couple pulls back the curtain on Hotel Sequoia to open an art center, called the Center for Creativity. It's a space for artists to display their works as well as a place for arts classes.

Gasparini worked with local artists and community leaders to open the space which she said was sorely needed in Redwood City.

"The last thing my husband and I wanted was a vacant ground floor," she said."This way, the lights are on and people are coming and going until it gets to what it wants to be, which is a boutique hotel."

Gasparini said the couple had secured financing to reopen the hotel right before the pandemic but COVID-19 killed their plans. She said the uncertain Bay Area hotel market has delayed funding further. She said they're hopeful for new financing and to finally open by 2027. She estimates the project will cost about $50 million.

Plans for the renovated hotels include adding two stories to the existing three, more than 70 rooms, a restaurant and a rooftop lounge.

In the meantime, the arts center, which cobbled together approximately $350,000 through grants, hopes to demonstrate that it can satisfy a need in Redwood City, said Jill Asher, a member of the center's steering committee. She said the ultimate aim is to raise $30 million to $60 million for a permanent center.

Gasparini said although the arts center won't be part of the hotel when it ultimately opens, they plan to continue displaying works from local artists.

Please contact Randy Diamond with your hotel tips at Randolphdiamond@gmail.com

More Travel

- How a sleepy coastal California city became a restaurant powerhouse

- Hawaii pod hotel hopes to attract Japanese tourists back to Islands

- Vegas Strip hotel giant reportedly cuts concierge at most of its resorts

- Denied landmark status, historic California Taco Bell gets surprising new lifeline

For more travel news and features, sign up for our TravelSkills newsletter here .

Sign up for newsletters here

Read the original article on